Y´s Yohji Yamamoto ドロップショルダー スタジャン

(税込) 送料込み

商品の説明

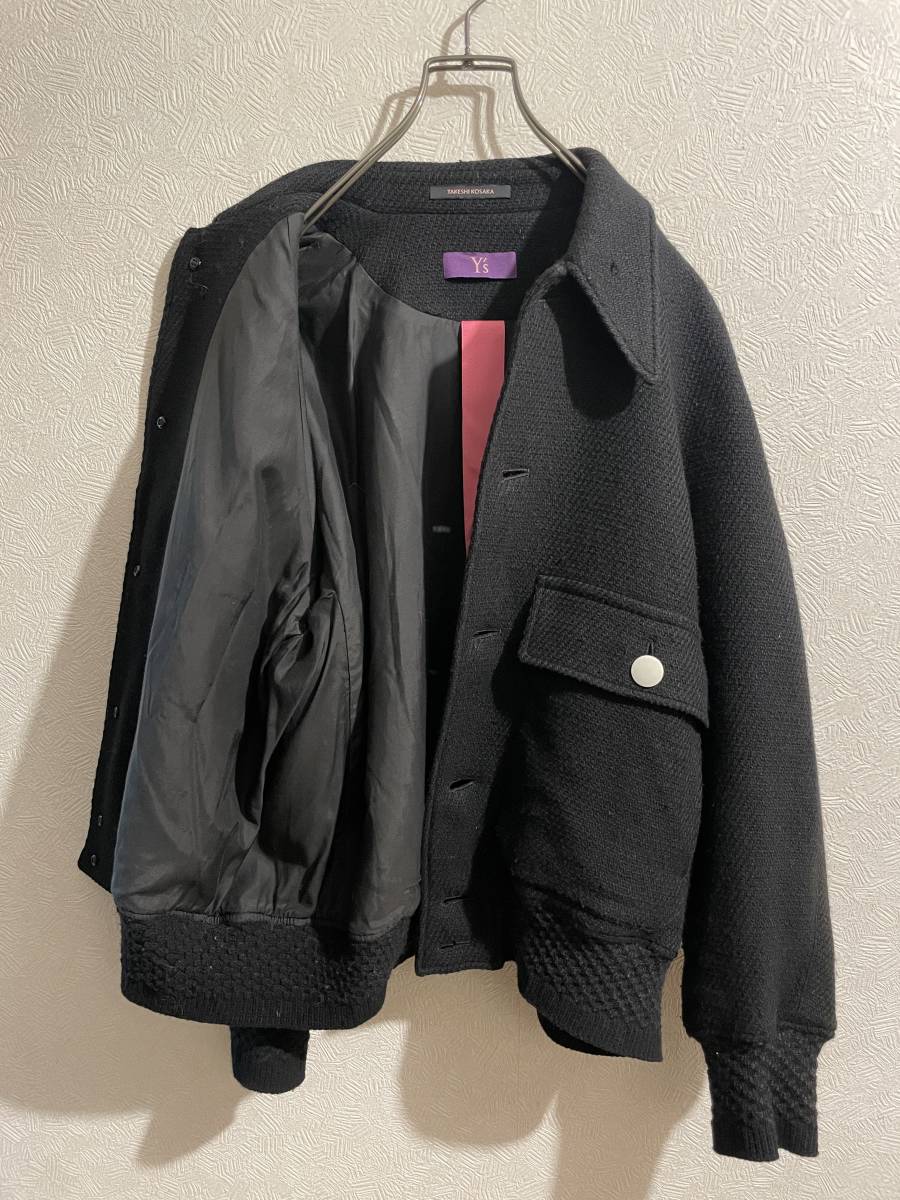

◯ Y"s Yohji Yamamoto ヨウジヤマモト ドロップショルダー スタジャン

◯ MADE IN JAPAN

◯ size : 2

肩幅 : ラグランの為測定不能

身幅 : 61cm

着丈 : 60cm

裄丈 : 85cm

◯ 色 : ブラック

◯ 素材 : ウール、リネン、コットン、ナイロン

◯ 商品説明 :

ツイードライクなウールボディに、スタジャンのディテール、白いボタンが目を引くクールなデザイン、

正面はラグラン、背面はドロップショルダーのようなイレギュラーな切り替えもユニークな表情を作ります。

ポインテッドカラー、大振りなポケット、網目状の凹凸のあるリブもアクセント、

ヨウジヤマモトならではのスタジャンのアップデートがモードに映えるハイクオリティなクリエーションです。

◯ 状態 : 左襟、背面右肩に細かいほつれ、多少の使用感はございますが、目立つ汚れやダメージは無く、まだまだお使い頂けるコンディションかと思います。

◯ 男性、女性問わず、ユニセックス にお使い頂けるアイテムかと思います。

◯ デッドストック や 新品 の状態を除き、全てクリーニング済みです。

◯ ご購入から2~3日で、発送させて頂きます。 発送方法は、追跡機能、補償のついているゆうパック、またはヤマト運輸で行います。

#Sirchive商品の情報

| カテゴリー | レディース > ジャケット/アウター > スタジャン |

|---|---|

| 商品のサイズ | M |

| ブランド | ヨウジヤマモト |

| 商品の状態 | 目立った傷や汚れなし |

Y's Yohji Yamamoto ドロップショルダー スタジャン | labiela.com

Y's Yohji Yamamoto ドロップショルダー スタジャン | labiela.com

Y's Yohji Yamamoto ドロップショルダー スタジャン | labiela.com

Y's Yohji Yamamoto ドロップショルダー スタジャン | labiela.com

Y's Yohji Yamamoto ドロップショルダー スタジャン | labiela.com

Y's Yohji Yamamoto ドロップショルダー スタジャン | labiela.com

Y's Yohji Yamamoto ドロップショルダー スタジャン | labiela.com

Y's Yohji Yamamoto ドロップショルダー スタジャン | labiela.com

新着商品 トラックジャケット GroundY ヨウジヤマモト グラウンドワイ

STAFF STYLING|THE SHOP YOHJI YAMAMOTO

![Amazon | [リディーコロ] オーバーサイズ スタジャン 薄手 韓国 ビッグ](https://images-fe.ssl-images-amazon.com/images/I/61LgX mTwfL._SLDPMOBCAROUSELAUTOCROP288221_MCnd_AC_SR462,693_.jpg)

Amazon | [リディーコロ] オーバーサイズ スタジャン 薄手 韓国 ビッグ

Dulcamara 22SS よそいきダブルジャケット

(AW21) Y-3 YOHJI YAMAMOTO , 11byBBS×Salomon. – LOOM

ヨウジヤマモト スタジャン(メンズ)の通販 29点 | Yohji Yamamotoの

STAFF STYLING|THE SHOP YOHJI YAMAMOTO

SHIWANOARU POLYESTER STRETCH TWILL LONG JACKET WITH MULTIPLE

ヨウジヤマモト スタジャン(メンズ)の通販 29点 | Yohji Yamamotoの

SHIWANOARU POLYESTER STRETCH TWILL LONG JACKET WITH MULTIPLE

CANADA GOOSE - カナダグース23AWフリースジャケットLawson Jacket

STYLING - (AW21) Y-3 YOHJI YAMAMOTO , 11byBBS×Salomon. – LOOM OSAKA

Y´s Yohji yamamoto コート ウクライナ巡り米国 - coroi.mu

STAFF STYLING|THE SHOP YOHJI YAMAMOTO

![Amazon | [リディーコロ] オーバーサイズ スタジャン 薄手 韓国 ビッグ](https://m.media-amazon.com/images/I/61BcR cp-NL._AC_UY580_.jpg)

Amazon | [リディーコロ] オーバーサイズ スタジャン 薄手 韓国 ビッグ

STAFF STYLING|THE SHOP YOHJI YAMAMOTO

SHIWANOARU POLYESTER STRETCH TWILL LONG JACKET WITH MULTIPLE

yohji yamamoto POUR HOMME(ヨウジヤマモトプールオム) / シワギャバ

STAFF STYLING|THE SHOP YOHJI YAMAMOTO

2023年最新】Yahoo!オークション -yohji yamamoto ジャケット(メンズ

STYLING - (AW21) Y-3 YOHJI YAMAMOTO , 11byBBS×Salomon. – LOOM OSAKA

![Amazon | [リディーコロ] オーバーサイズ スタジャン 薄手 韓国 ビッグ](https://m.media-amazon.com/images/I/51kcTh75JBL._AC_UY580_.jpg)

Amazon | [リディーコロ] オーバーサイズ スタジャン 薄手 韓国 ビッグ

STAFF STYLING|THE SHOP YOHJI YAMAMOTO

Y´s BANG ON! no.11 袴パンツ Yohji Yamamoto 商品一覧の通販 laverite.mg

STAFF STYLING|THE SHOP YOHJI YAMAMOTO

yohji yamamoto POUR HOMME(ヨウジヤマモトプールオム) / シワギャバ

ヨウジヤマモト スタジャン(メンズ)の通販 29点 | Yohji Yamamotoの

Yohji Yamamoto ドロップショルダー シャツ - Farfetch

ヨウジヤマモト スタジャン(メンズ)の通販 29点 | Yohji Yamamotoの

STAFF STYLING|THE SHOP YOHJI YAMAMOTO

楽天市場】【Y-3】ワイ・スリー トラックジャケット フルジップ

ヨウジヤマモト スタジャン(メンズ)の通販 29点 | Yohji Yamamotoの

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています