チェスト 収納ボックス 本棚 家具 整理整頓 ボックス ヴィンテージ 新品

(税込) 送料込み

商品の説明

新品未使用 即決ok

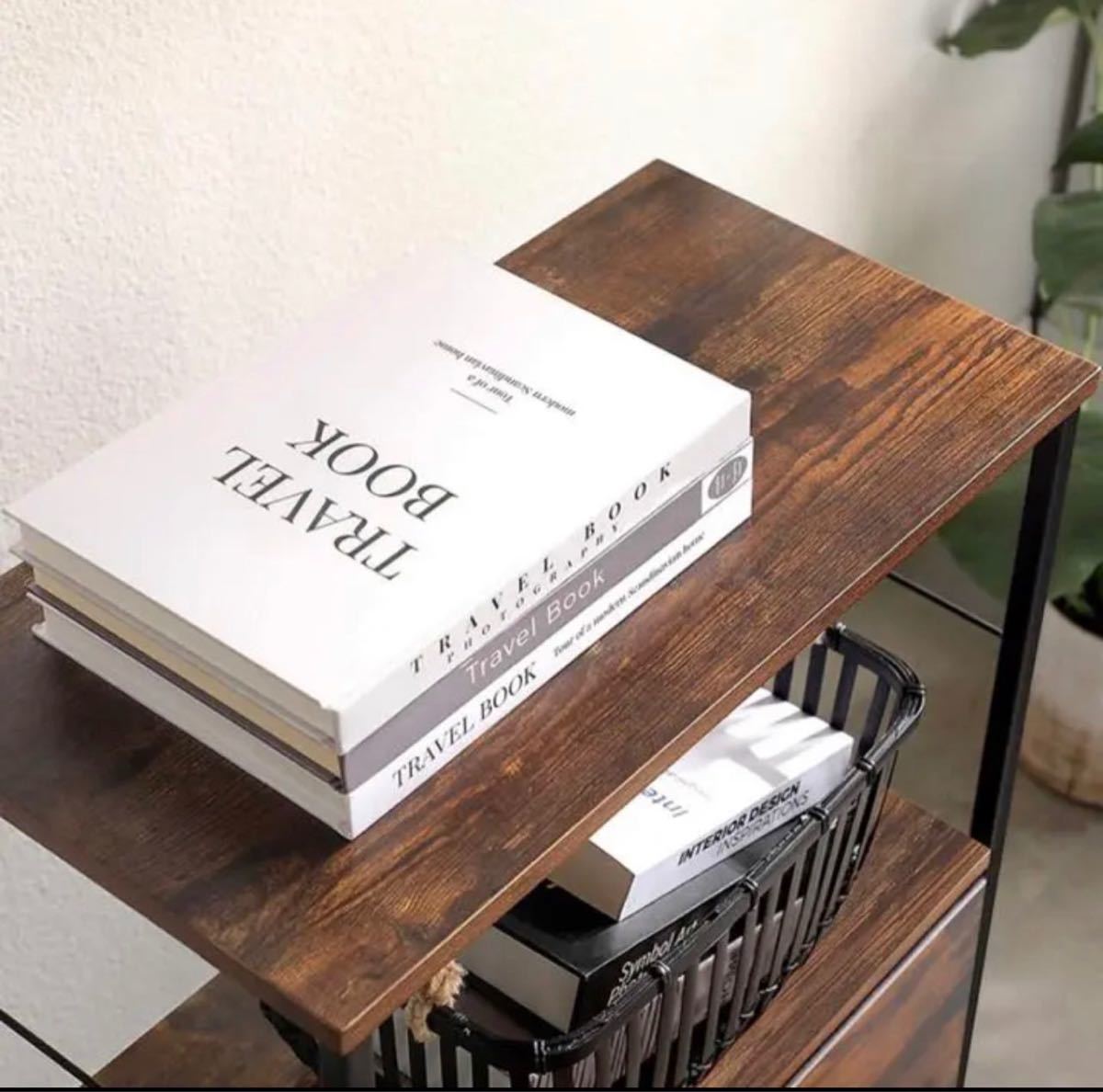

棚板はそれぞれ奥行きが異なるので、小物から大型本まで、大小さまざまなものを収納できます 必要なものを探しやすく、取り出しやすいオープンシェルフ。

木目調の天板とスチールフレームという組み合わせが、落ち着いた大人の雰囲気を演出するインテリアシリーズの登場です。

棚板の一段の耐荷重が15kgとしっかりとした作りになっています。重いものを置いても余裕です。

こちらのシェルフは、本や小物を並べたり、植物を置いたり、食器を飾ったりと、オープンタイプならではの自由な使い方が可能です。

商品サイズ(約):幅176.5*奥行30*高さ163.5(cm)。商品重量(約):34.7kg。耐荷重(約):天板8kg/棚板各15kg。材質:合成樹脂化粧パーティクルボード(メラミン樹脂)・スチール。

#本棚 #棚 #ラック#丈夫#スチールフレーム#食器棚#IKEA#イケア#SKUBB#スクッブ#収納#RÅSHULT#ロースフルト#ワゴン#ホワイト#イケア#IKEA#ふきん#北欧雑貨#キッチンリネン#スチールラック#インスタ#北欧#海外インテリア#ホワイトインテリア#収納ケース#収納 #スクッブ #押し入れ#クローゼット#IKEA #イケア #ハンガー #フック #ドア #ポール #インテリア #洋服ハンガー #NITORI #ニトリ #インテリア #DIY #整頓 #整理整頓 #棚 #ボックス#パソコン#ウッド#ヴィンテージ#レトロ#ビジネス#家具商品の情報

| カテゴリー | インテリア・住まい・小物 > 収納家具 > 棚/ラック |

|---|---|

| 商品の状態 | 新品、未使用 |

チェスト 収納ボックス 本棚 家具 整理整頓 ボックス ヴィンテージ

チェスト 収納ボックス 本棚 家具 整理整頓 ボックス ヴィンテージ

チェスト 収納ボックス 本棚 家具 整理整頓 ボックス ヴィンテージ

チェスト 収納ボックス 本棚 家具 整理整頓 ボックス ヴィンテージ

チェスト 収納ボックス 棚 本棚 家具 整理整頓 ボックス ヴィンテージ 新品

チェスト 収納ボックス 本棚 家具 整理整頓 ボックス ヴィンテージ

チェスト 収納ボックス 本棚 家具 整理整頓 ボックス ヴィンテージ

チェスト 収納ボックス 本棚 家具 整理整頓 ボックス ヴィンテージ

チェスト 収納ボックス 本棚 家具 整理整頓 ボックス ヴィンテージ

チェスト 収納ボックス 本棚 家具 整理整頓 ボックス ヴィンテージ 新品

チェスト 収納ボックス 棚 本棚 家具 整理整頓 ボックス ヴィンテージ

販売中の商品 チェスト 収納ボックス 棚 本棚 家具 整理整頓 ボックス

チェスト 収納ボックス 本棚 家具 整理整頓 ボックス ヴィンテージ

チェスト 収納ボックス 本棚 家具 整理整頓 ボックス ヴィンテージ

チェスト 収納ボックス 棚 本棚 家具 整理整頓 ボックス ヴィンテージ

Amazon.co.jp | チェスト 収納ボックス 棚 本棚 家具 整理整頓

男女兼用 チェスト 収納ボックス 本棚 家具 整理整頓 ボックス

チェスト 収納ボックス 本棚 家具 整理整頓 ボックス ヴィンテージ

チェスト 収納ボックス 本棚 家具 整理整頓 ボックス ヴィンテージ

期間限定 チェスト 収納ボックス 棚 本棚 家具 整理整頓 ボックス

キッチンリ】 チェスト 収納ボックス 棚 本棚 家具 整理整頓 ボックス

チェスト 収納ボックス 本棚 家具 整理整頓 ボックス ヴィンテージ

チェスト 収納ボックス 本棚 家具 整理整頓 ボックス ヴィンテージ

チェスト 収納ボックス 本棚 家具 整理整頓 ボックス ヴィンテージ

安い本物保証】 チェスト 収納ボックス 棚 本棚 家具 整理整頓

チェスト 収納ボックス 本棚 家具 整理整頓 ボックス ヴィンテージ

キッチンリ】 チェスト 収納ボックス 棚 本棚 家具 整理整頓 ボックス

カラー】 チェスト 収納ボックス 棚 本棚 家具 整理整頓 ボックス

チェスト 収納ボックス 棚 本棚 家具 整理整頓 ボックス ヴィンテージ

チェスト 収納ボックス 本棚 家具 整理整頓 ボックス ヴィンテージ

100%新品低価】 チェスト 収納ボックス 本棚 家具 整理整頓 ボックス

チェスト 収納ボックス 本棚 家具 整理整頓 ボックス ヴィンテージ

チェスト 収納ボックス 本棚 家具 整理整頓 ボックス ヴィンテージ

チェスト 収納ボックス 棚 本棚 家具 整理整頓 ボックス ヴィンテージ

チェスト 収納ボックス 本棚 家具 整理整頓 ボックス ヴィンテージ

チェスト 収納ボックス 棚 本棚 家具 整理整頓 ボックス ヴィンテージ

チェスト 収納ボックス 本棚 家具 整理整頓 ボックス ヴィンテージ

キッチンリ】 チェスト 収納ボックス 棚 本棚 家具 整理整頓 ボックス

チェスト 収納ボックス 本棚 家具 整理整頓 ボックス ヴィンテージ

クリアランス卸し売り チェスト 収納ボックス 本棚 家具 整理整頓

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています