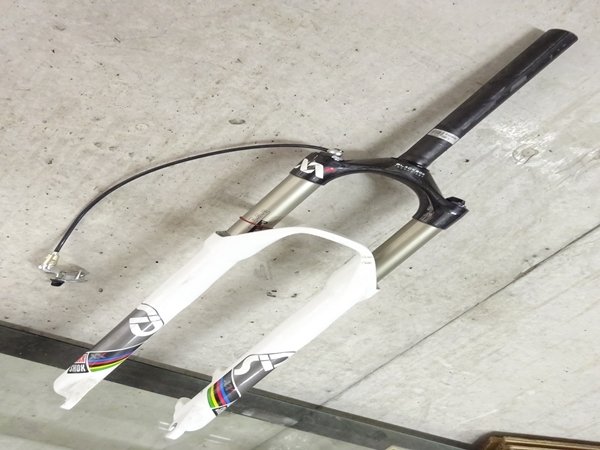

ロックショックスSIDサスペンションフォーク

(税込) 送料込み

商品の説明

用途・素材...マウンテンバイク

2013年モデル

超軽量設計で、クロスカントリーレースで最も評判の高いフォーク

・用途: Cross Country

・トラベル: 100mm

・Springs: Solo Air

・コラム長:180ミリ

・Adjustments

XLoc - handlebar remote

External Rebound

Lockout Threshold - Low Speed Compress

・Steerer

Aluminum

180mm unabridged length

・Wheel size: 26 inch

・Weight: 1420g

2015年頃、海外通販で購入しました。

年数回の使用で走行距離は1000キロ未満です。

エア漏れ、オイル漏れ等の不具合はありませんがリモートロックアウトの動作が鈍い時があります。ロックアウトはしっかり効きます。

室内保管のため目立つ傷もなく艶のある綺麗な状態です。

タグ

ジャイアント

キャノンデール

コナ

GT

シマノ

ビアンキ

サンタクルーズ

スコット

スペシャライズド

ロッキーマウンテン

マングース商品の情報

| カテゴリー | スポーツ・レジャー > 自転車 > パーツ |

|---|---|

| ブランド | スラム |

| 商品の状態 | 目立った傷や汚れなし |

ロックショックス・SIDアルティメイト。 実装着インプレッション

RockShox SID SL Select Charger RL サスペンションフォーク - 29インチ、100mm、15 x 110mm、44mmオフセット、拡散ブラック、リモート、C1

ロックショックス・SIDアルティメイト。 実装着インプレッション

RockShox SID Select Charger RL サスペンションフォーク - 29インチ、120mm、15 x 110mm、44mmオフセット、拡散ブラック、リモート、C1

rockshox sid s-works brain サスペンションフォーク | video.aacntv.com

ルナ サイクル(修理・調整 サスペンションフォーク編 その2)

RockShox SID SL Ultimate BRAIN

ロックショック ROCKSHOX シドレースデュアルエアー SID RACE DUAL AIR サスペンションフォーク 26インチ Vブレーキ 100mm : cps-2011138004-pa-037650342 : CYCLE PARADISE - 通販 - Yahoo!ショッピング

3年保証』 B1190 ロックショックス ROCKSHOX SID フロントフォーク

最大100mmのトラベル量を持つ軽量サスペンションフォーク「ロック

Sram Rockshox SID 27.5 サスペンションフォーク QR | eclipseseal.com

CY-BOSS / 【13P1415】ROCKSHOX SID World Cup フロントサス 26インチ

ROCKSHOX「ロックショックス」 SID HYDRA AIR φ28.6(1-1⁸/₁) 65mm サスペンションフォーク / 浜松店

ROCKSHOX「ロックショックス」 SID HYDRA AIR φ28.6(1-1⁸/₁) 65mm サスペンションフォーク / 浜松店

予約受付中】 ROCKSHOX SID ロックショックス サスペンションフォーク

ROCKSHOX「ロックショックス」 SID HYDRA AIR φ28.6(1-1⁸/₁) 65mm サスペンションフォーク / 浜松店

有名なブランド △ロックショックス SID 26インチ対応 カーボン

1円 超軽量 旧車にどうぞ ROCKSHOX SID XC ロックショックス フロント

ROCK SHOX】SID race 26in 軽量サスペンションフォーク smcint.com

柔らかい 最高峰 RS-1 ROCKSHOX SRAM フロントフォーク リモートロック

Amazon | RockShox SID SL Ultimate Race Day サスペンションフォーク

豪奢な ROCKSHOX ロックショックス REBA SL サスペンション フォーク

RockShox SID SL Ultimate Race Day サスペンションフォーク - 29インチ、100mm、15 x 110mm、44mmオフセット、グロスブラック、C1

無料配達 ROCKSHOX RECON ブースト 51mmオフセット 120mm 29インチ

ROCKSHOX ( ロックショックス ) サスペンションフォーク ZEB SELECT 29

ROCKSHOX SID RACE Fサスペンション www.krzysztofbialy.com

最新作 ULTIMATE SID ROCKSHOX 新品 29er トラベル:110mm リモート

ROCK SHOX(ロックショックス)SID TEAMフロントサスペンションフォーク

ロックショック ROCK SHOX SID WC BRAIN サスペンションフォーク 29

ROCKSHOX SID RACE Fサスペンション www.krzysztofbialy.com

ロックショック ROCKSHOX シドワールドカップデュアルエアー

ルナ サイクル(修理・調整 サスペンションフォーク編 その2)

得価HOT ロックショック ROCK SHOX SID XX サスペンションフォーク 29

ROCKSHOX ロックショックス SID RACE CARBON フロントサスペンション

最新作 ロックショックス ROCKSHOX PIKE 27.5 【コラムカット有

RockShox SID Ultimate Race Day サスペンションフォーク | 29インチ

ロックショックス ROCKSHOX SID フロントフォーク サスペンション

プライスダウン開始】ロックショック ROCK SHOX SID WC BRAIN

2023年最新】Yahoo!オークション -rockshox(サスペンションフォーク)の

1円 希少 ROCKSHOX ロックショックスSID RACE サスペンションフォーク

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています