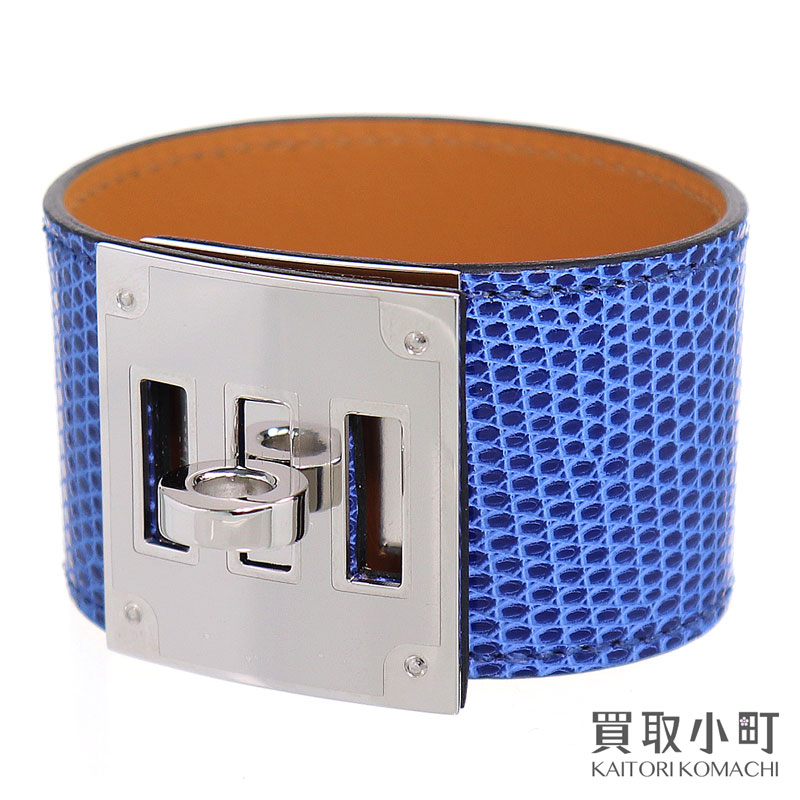

エルメス ケリー バングル リザード 未使用品

(税込) 送料込み

商品の説明

エルメス

ケリー

バングル

ブレスレット

未使用品

外径65

内径62

リザード

綺麗なブルー✖️イエローゴールド

ブランドショップにて購入しましたが、なかなか使用する機会がなかったので出品致します。

ブランドショップにて鑑定済みのお品

#HERMES

#エルメス

#ブレスレット

#バングル

#ケリー商品の情報

| カテゴリー | レディース > アクセサリー > ブレスレット |

|---|---|

| ブランド | エルメス |

| 商品の状態 | 新品、未使用 |

美品】 《美品》 エルメス ケリー バングル リザード ゴールド

日本最大級 エルメス バングル ケリー カデナ 銀 リザードレザー 革

品質のいい エルメス バングル H ケリー カデナ リザードレザー 革

Hermes - エルメス オランプ ブレスレット ファン バングル メタル

楽天市場】【未使用品】エルメス【HERMES】ケリー ドッグ

1着でも送料無料 エルメス ブレスレット ケリーバングル ブレスレット

エルメス ケリードッグ ブレスレット レザー HERMES-

激安超安値 レザー ブルー ゴールド GP ブレスレット カデナ リザード

楽天市場】【未使用品】エルメス【HERMES】ケリー ドッグ

Hermes - エルメス オランプ ブレスレット ファン バングル メタル

2023年最新】エルメス バングル ケリーの人気アイテム - メルカリ

未使用 展示品)エルメス HERMES ケリー バングル ブレスレット レザー

バイセル公式】エルメス ケリードッグ ブレスレット バングル リザード

1着でも送料無料 エルメス ブレスレット ケリーバングル ブレスレット

HERMES エルメス ブレスレット オレンジ R刻印 未使用品 新宿伊勢丹購入-

週末限定:エルメス ケリー バングル ブレスレット レア リザード エルメス 【送料無料(一部地域を除く)】

まとめ買い】 HERMES エルメス ケリードッグ レア 未使用品

最先端 Hermes エルメス ケリー ブレスレット ブレスレット - biela.ec

バイセル公式】エルメス ケリードッグ ブレスレット バングル リザード

HERMES エルメス ブレスレット ケリーバングル レッド リザード

第1位獲得!】 (新品・未使用品)エルメス 箱付 H072991CC C刻印

エルメス ケリー ブレスレットの通販|au PAY マーケット

楽天市場】【未使用品】エルメス【HERMES】ケリー ドッグ

エルメス(HERMES)ケリードッグ|ブレスレット|リザードナチュラ

美品》 エルメス ケリー バングル リザード ゴールド×グリーン 【好評

HERMES エルメス ケリー バングル ゴールド/グリーン | eclipseseal.com

新品・未使用】エルメス ケリードック ブレスレット 買得 tvcenario.com

中古】エルメス バングル ブレスレット シェーヌダンクル リザード

Hermes - エルメス オランプ ブレスレット ファン バングル メタル

リザード ケリーの値段と価格推移は?|7件の売買データからリザード

HERMES ケリーリザードバングル - ブレスレット/バングル

経典 Hermes - エルメス HERMES ケリー ボリード ショルダー

買い保障できる HERMES エルメス ケリーバングル バングル/リスト

◇HERMES☆エルメス☆ケリーブレスレット☆U刻印☆新品未使用

人気特価激安 HERMES エルメス レザー HERMES HERMES ケリー

国内発送 エルメス HERMES シェーヌダンクル ブレスレット 24cm

ロデオドライブ | エルメス | ミニケリー2 | ハンドバッグ | リザード

フランス購入品 新品 エルメス モンプティケリー ペンダント PM

エルメス ケリーブレスレット バングル 赤 | labiela.com

エルメス ケリーブレスレット リザード 2175500002521の通販なら

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています