筋膜リリース DVD 5本セット

(税込) 送料込み

商品の説明

筋膜リリース DVD 5本セット

〜その理論から治療手順まで〜

解説・実技︰竹井仁

総発売元 ジャパンライム株式会社

※ばら売りは致しません。※

ケース、ディスクに若干のスレ傷有り。

神経質な方はご遠慮下さい。商品の情報

| カテゴリー | 本・音楽・ゲーム > DVD/ブルーレイ > その他 |

|---|---|

| 商品の状態 | やや傷や汚れあり |

筋膜リリース DVD 5本セット 【本物保証】

DVDでわかる! 筋膜リリースパーフェクトガイド──筋膜博士が教える

DVDでわかる! 筋膜リリースパーフェクトガイド──筋膜博士が教える

筋膜リリース ~その理論から治療手順まで~ 実技・解説:竹井仁

筋膜リリースストレッチ 五輪書】 小峰恵 整体DVD | 手技DVDドット・コム

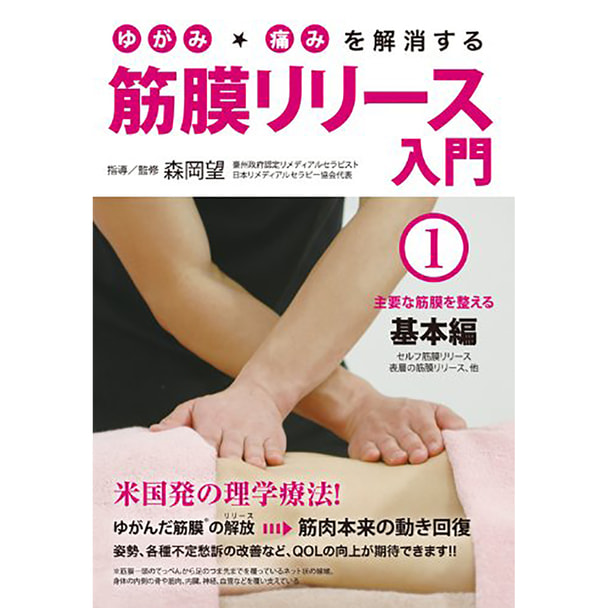

【DVD】 ゆがみ・痛みを解消する 筋膜リリース入門 第1巻 主要な筋膜を整える基本編の卸・通販 | ビューティガレージ

DVD】筋筋膜リリース・セラピー | 医道の日本社(公式ショッピング

DVDでわかる! 筋膜リリースパーフェクトガイド──筋膜博士が教える

DVDでわかる! 筋膜リリースパーフェクトガイド 筋膜博士が教える

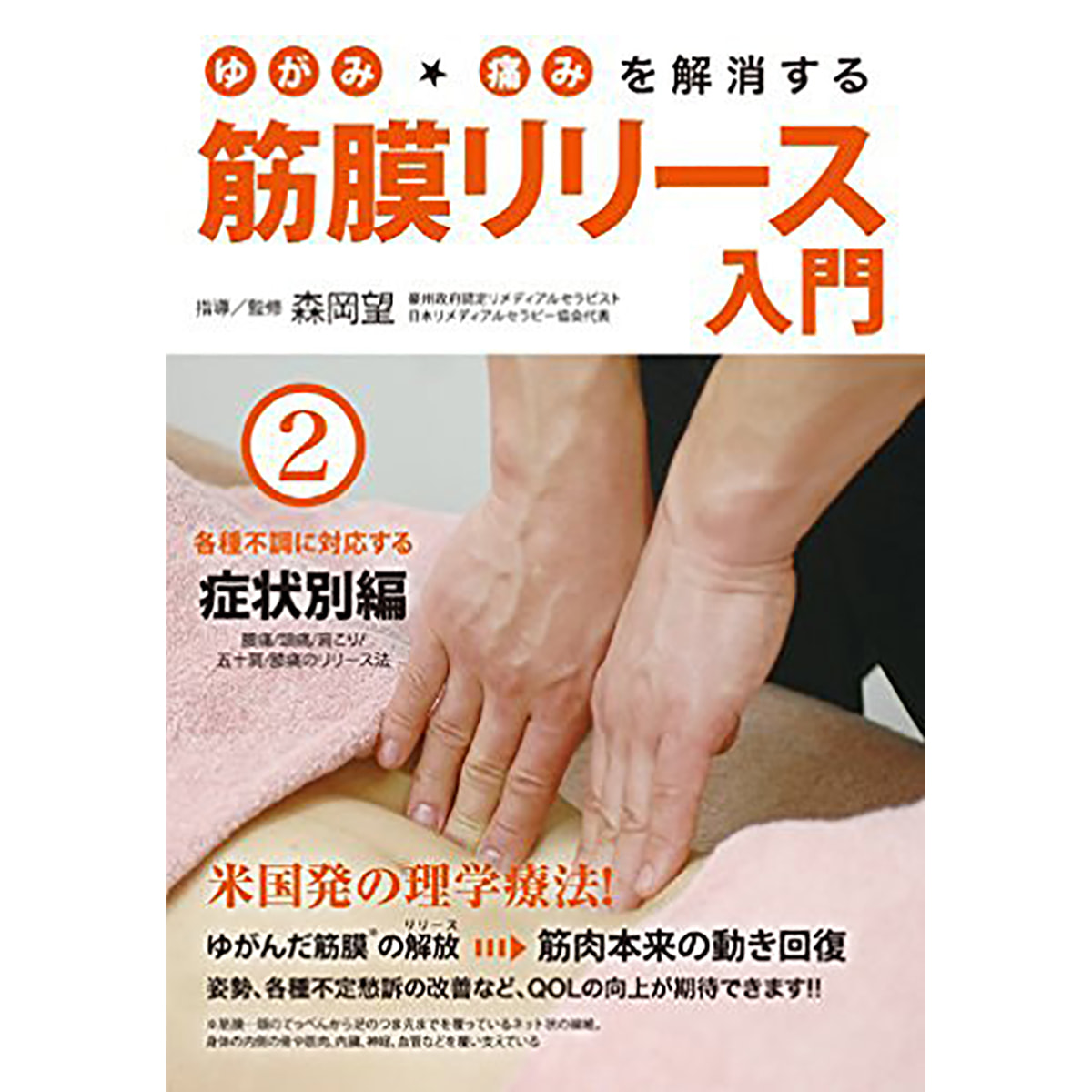

【DVD】 ゆがみ・痛みを解消する 筋膜リリース入門 第2巻 各種不調に対応する症状別編

Amazon | 24時間以内発送!整体DVD本編3枚+特典冊子筋膜リリース

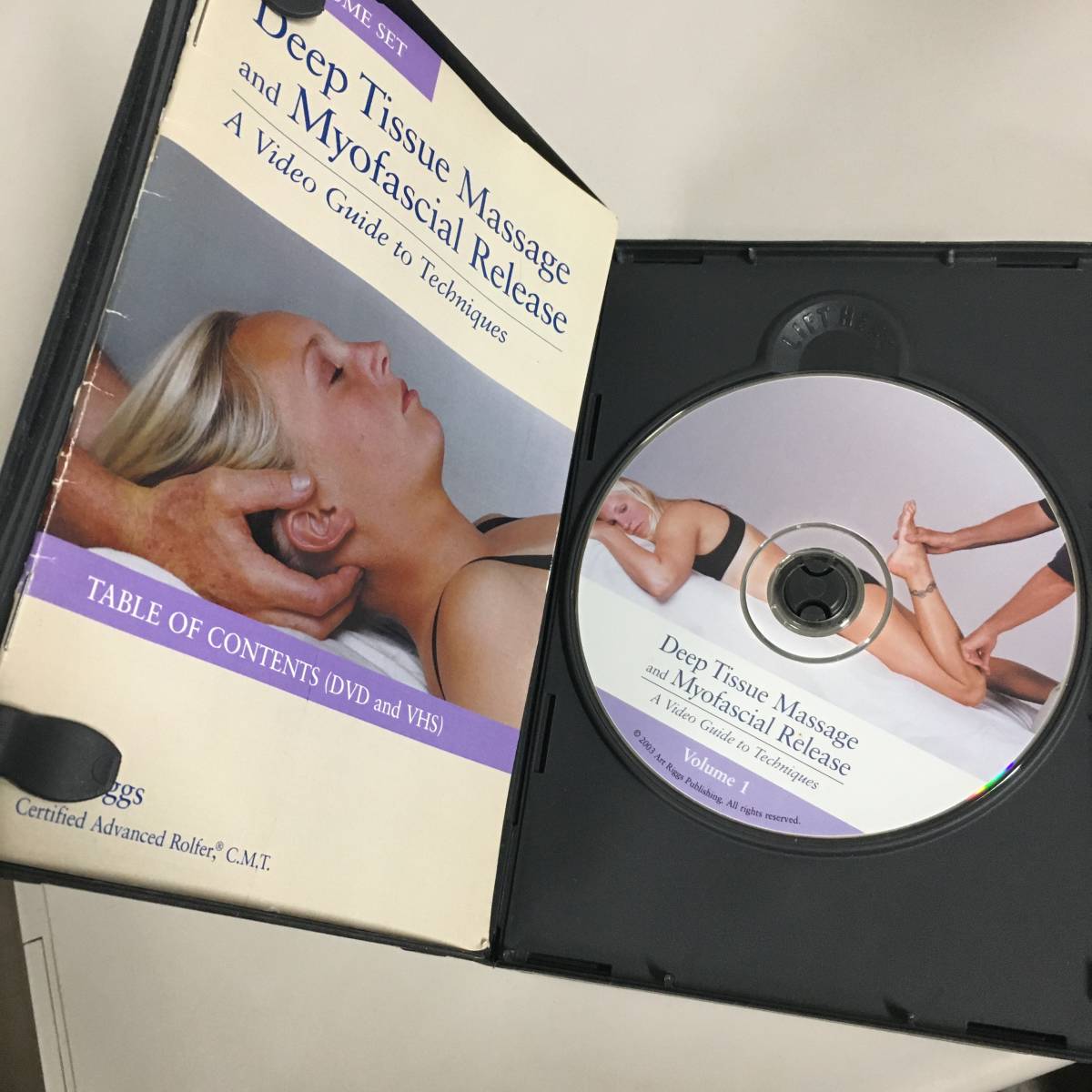

買取り実績 Release Myofascial and Massage Tissue ○Deep DVD (全7枚

フォームローラー セット 筋膜リリース 筋膜 脚やせ 硬め 細い 細

1日1分 筋膜リリース -痛みとこりがラクになる- | 滝澤 幸一 |本

フォームローラー 2個 セット 筋膜ローラー 脚やせ ストレッチローラー

フォームローラー 2個 セット 筋膜ローラー 脚やせ ストレッチローラー

やせる! 筋膜リリース ダイエット編──筋膜博士が教える決定版 | 竹井

楽天ブックス: 自分でできる!筋膜リリースパーフェクトガイド - 筋膜

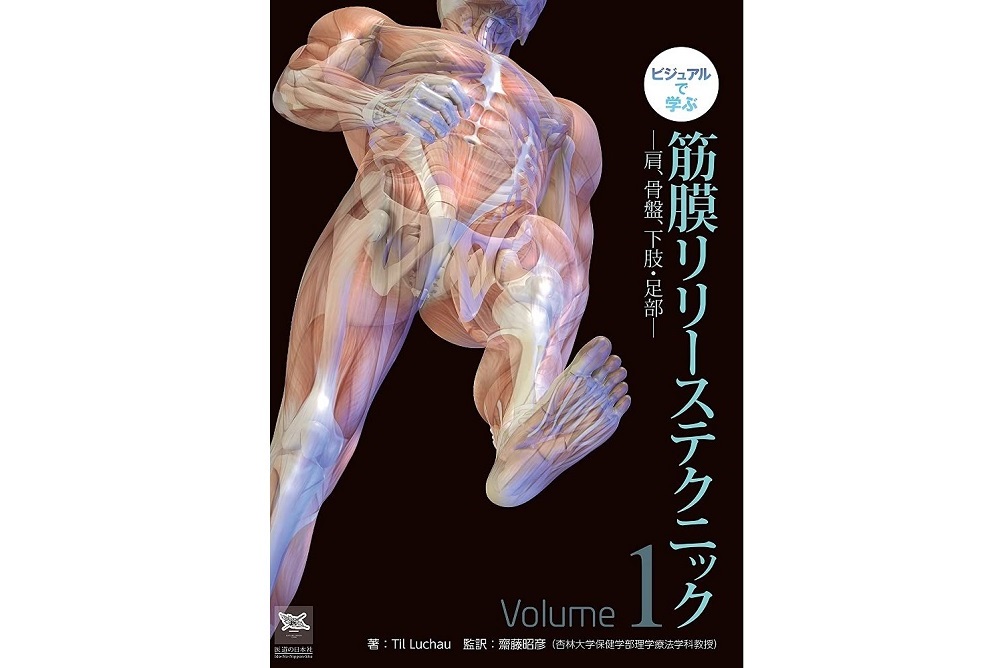

ビジュアルで学ぶ 筋膜リリーステクニック Vol.1 ―肩、骨盤、下肢・足

フォームローラー セット 筋膜リリース 筋膜 脚やせ 硬め 細い 細

Amazon | 【大・小2個セット】 GetFit 筋膜ローラー フォームローラー

未使用】筋膜リリースセラピスト DVD キャリアカレッジ キャリカレ

魔法の筋膜リリース パーフェクト5種6点セット 最速 柔軟 ストレッチ

キレイ! 筋膜リリース ビューティー編──筋膜博士が教える決定版

魔法の筋膜リリース パーフェクト5種6点セット 最速 柔軟 ストレッチ

筋膜リリース DVD 5本セット 【本物保証】

中古】Deep Tissue Massage and Myofascial Release DVD 深部組織

ビジュアルで学ぶ 筋膜リリーステクニック Vol.1 | 医道の日本社(公式

魔法の筋膜リリース パーフェクト5種6点セット 最速 柔軟 ストレッチ

やさしい筋膜リリースのやり方 (サクラムック 楽LIFEヘルスシリーズ)

買取り実績 Release Myofascial and Massage Tissue ○Deep DVD (全7枚

5点セット ヨガポール フォームローラー ストレッチ 筋膜リリース

NOVAマッスルガン 筋膜リリースセット | ABCミッケ|【公式】ABC

IMPHY / インフィ 】リリーススティックPC 3柄 全身 筋膜リリース 疲労

自分でできる! 筋膜リリースパーフェクトガイド──筋膜博士が教える

どんな筋膜の本が人気? amazon売れ筋ランキング:スタジオ・ヨギー

フォームローラー セット 脚やせ 筋膜ローラー ストレッチローラー

楽天ビック|筋膜リリースとは?肩こりや猫背を改善する筋膜リリースの

増補改訂版 ファッシャルリリーステクニック ―筋膜を治療して身体構造

Drizzle フォームローラー 筋膜リリース ヨガポール ストレッチ スティック 5点セット ローラー ショート ハーフ エクササイズ トレーニング 器具 収納袋付き (オレンジ)

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています